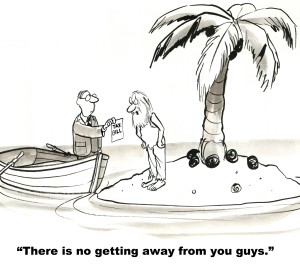

If you have a tax debt that you are unable to pay in full, an “offer in compromise” allows you to settle this debt for less than the full amount owed. This is a viable option if you’re unable to pay the debt in full, or if doing so would cause a financial hardship on you, your family or your business.

I work as a liaison between you and the IRS to help determine an agreed upon amount that you will be able to pay. The government may approve of an offer in compromise when the amount offered “represents the most they can expect to collect within a reasonable timeframe.”

F.Y.I.: Before you can submit an offer in compromise you must be current with all of your tax filings and other qualifications. I can work with you to bring you current and see if you pre-qualify as an Offer in Compromise candidate.